1.0 AI Glasses: Definition, Classification, and Core Competitiveness

As the next generation of intelligent terminals in the consumer electronics field, following smartphones and TWS earphones, AI glasses are ushering in a new era of personal computing with their unique form factor and interaction methods. Their strategic importance lies in their potential to serve as a seamless bridge between the physical and digital worlds, reshaping paradigms of information acquisition and human-computer interaction. This chapter begins by providing a clear definition of AI glasses, analyzing their core competitiveness and market classifications, and laying a solid foundation for an in-depth exploration of their complex supply chain systems and manufacturing challenges.

Product Definition

AI glasses, short for Artificial Intelligence Glasses, are eyeglass products integrated with intelligent functionalities. They represent not just an evolution of traditional eyewear but an entirely new smart hardware platform. Their core advantage lies in leveraging the unique attribute of glasses as accessories that can be worn for extended periods, allowing embedded generative AI models to continuously interact with users and their environments, thereby unlocking potential far beyond other devices.

Core Competitiveness

The essence of AI glasses is the high-level integration of hardware (audio, video, augmented reality waveguides) and on-device models. Their core competitiveness stems not from a single technological breakthrough but from the combination of two key elements:

- Multimodal Interaction

By integrating audio, video, and sensors, AI glasses can understand and respond to user voice commands, gestures, and even environmental changes, delivering a more natural and intuitive interaction experience than traditional devices. - Lightweight Design

Successful AI glasses must balance powerful functionality with the lightweight and comfortable feel of traditional eyewear. This demands extreme engineering precision in materials, structure, and component miniaturization.

Market Classification

Based on functional emphasis and technological pathways, AI glasses in the current market can be categorized into three main types:

| Category | Product Features | Representative Brands | Comparable Products |

|---|---|---|---|

| AI Audio Glasses | Focus on audio functionality, no screen interaction, dominated by acoustic experience. | Huawei Smart Glasses 2, MIJIA Smart Audio Glasses | Open-ear Headphones |

| AI Camera Glasses | Build on audio glasses with added cameras and sensors, emphasizing AI photography and real-time interaction. | Li Weike MetaLens ChatAI, Shanji A1, Ray-Ban Meta | Action Cameras |

| AI AR Glasses | Integrate micro-displays and optical solutions on top of the above two categories, supporting lightweight information prompts or immersive spatial computing. | Rokid Glasses, XREAL One | Smartphones (partial functionality) |

Currently, these three product categories are advancing at different paces, driven by their respective application scenarios, collectively propelling the evolution of the industry.

2.0 Market Status and Growth Trajectory Analysis

For any manufacturing or supply chain enterprise looking to enter the AI glasses market, a profound understanding of its market dynamics and growth potential is a prerequisite for strategic planning. This chapter analyzes market shares across different product categories, shipment forecasts from authoritative institutions, and comparisons with mature markets to reveal that the AI glasses industry is on the cusp of explosive growth.

Market Shipment Analysis

According to data from Runto Technology, the market landscape of the three AI glasses categories is rapidly evolving:

- AI Camera Glasses and AI Audio Glasses dominate the market growth, driven by mature technology and affordable pricing, with the fastest shipment rates.

- AI AR Glasses, due to ongoing challenges in display technology, power consumption, and cost control, have not yet achieved full market acceptance, leading to significant fluctuations in their market share.

Forecasts from the international research firm IDC further validate this trend. It is projected that by 2025, the global shipments of non-display AI audio glasses and AI camera glasses will reach 5.47 million units, a remarkable year-on-year growth of 101.9%, indicating strong momentum.

Overall Market Growth Forecast

From a broader perspective, the AI glasses industry has already experienced a “breakout moment” similar to the release of AirPods. Driven by iconic products like Ray-Ban Meta and fueled by the wave of AI large models, the industry is poised to enter a multi-year period of rapid growth. According to Wellsenn forecasts, the AI glasses market is expected to achieve a staggering Compound Annual Growth Rate (CAGR) of 134% from 2023 to 2030, with its growth curve closely mirroring the early explosive phase of the TWS earphones market.

Key Insight: Simultaneous Boom in White-Label and Brand Markets

A noteworthy phenomenon is that the AI glasses market is not solely driven by leading brands; a vibrant white-label market is emerging in parallel, acting as another major engine for industry growth.

- Demand Growth: Demand from the mid-to-low-end market (including channel brands, OEM/ODM manufacturers, and Huaqiangbei enterprises) is growing even faster than the brand market. Currently, approximately 50 to 100 smart glasses companies have entered the market, with the mid-to-low-end segment expected to account for 30% of the total market share this year.

- Shipment Dominance: Data shows that white-label AI glasses have become a significant force in shipments on cross-border e-commerce platforms. For example, on Amazon’s smart glasses category in Q4 2024, white-label products accounted for 43% of the market. With an average selling price of just $89 (52% lower than branded products) and a 38% gross margin, these products demonstrate strong market competitiveness.

The macro growth trend of the market is clear: both branded and white-label segments are expanding rapidly. This robust growth will inevitably place higher demands on the upstream supply chain while presenting unprecedented opportunities.

3.0 Comprehensive Analysis of the AI Glasses Supply Chain

Behind any mature industry lies a robust, efficient, and collaborative supply chain ecosystem. As a complex product integrating optics, acoustics, electronics, and precision manufacturing, the breadth and depth of the AI glasses industrial chain are particularly critical. This chapter provides a comprehensive overview of the upstream, midstream, and downstream industrial chain of AI glasses and highlights its core characteristics at this stage, particularly the high degree of overlap and significant geographical concentration.

Industrial Chain Overview

Upstream: Core Component Suppliers

- Chips:

International: Qualcomm, Nordic Semiconductor, STMicroelectronics, NXP, TI, etc.

Domestic: Actions Semiconductor, Rockchip, Netcom Technologies, GigaDevice, SG Micro, Espressif Systems, ZKLink, etc. - Sensors:

International: TDK, Bosch, ams OSRAM, etc.

Domestic: Chipone Technology, Silergy, OmniVision, etc. - Camera Modules: Sunny Optical, Goertek, OFILM, Largan Precision, Crystal-Optech, Q-Tech, etc.

- Optical Displays:

International: Sony, Lumus, Tooz (Zeiss subsidiary), etc.

Domestic: Seeya Technology, BOE, Crystal-Optech, Aurora Optoelectronics, Lingxi Micro-Optics, Goertek Optics, etc. - Acoustic Modules: Goertek, AAC Technologies, MEMSensing, Guoguang Electric, etc.

- Power and Thermal Management:

Batteries: Desay Battery, Sunwoda, Zhongke Lanxun, ATL, EVE Energy, etc.

Thermal Solutions: Jones Tech, Fei Rong Da, Sicuan Materials, etc. - Structural Components:

Lenses/Frames: Lens Technology, EssilorLuxottica, Lingyi iTech, etc.

Hinges: Jinyan Technology, Fusida, Changying Precision, etc.

Connectors: Luxshare Precision, Changying Precision, Lianchuang Technology, Deren Electronics, etc. - Circuit Boards (FPC & PCBA): Avary Holding, Dongshan Precision, Shennan Circuits, Jingwang Electronic, etc.

- Communication Modules: Quectel, USI, MeiGe Smart, Fibocom, etc.

Midstream: ODM/OEM/EMS Assembly

Goertek, Luxshare Precision, Huaqin Technology, Jiahe Intelligent, Yidong Information, Tianjian Shares, Guoguang Electric, Foxconn, Longcheer Technology, Pegatron, etc.

Downstream: Brand Manufacturers

Ray-Ban Meta, Huawei, Xiaomi, OPPO, Thunderbird Innovation, XREAL, INMO, Shanji, etc.

Supply Chain Characteristics: High Degree of Overlap

In the early stages of industry development, the AI glasses supply chain exhibits a high degree of overlap. Whether for international brands or domestic newcomers, their core supplier lists share significant commonalities.

Supply Chain Comparison: Xiaomi vs. Ray-Ban Meta

| Component | Xiaomi AI Glasses | Ray-Ban Meta | Supply Chain Consistency |

|---|---|---|---|

| Main Chip | Qualcomm, Actions | Qualcomm | ✔️ |

| Storage (ePOP) | Netcom Technologies | Netcom Technologies | ✔️ |

| PCBA | Thundersoft | Longcheer Technology | |

| Camera | Sony/Sunny Optical/OFILM | Sony/Sunny Optical | ✔️ |

| Acoustic Module | Knowles/AAC | Goertek | |

| Battery/Cell | ATL/Desay | Desay | ✔️ |

| Structural Components | Changying Precision | Changying Precision, Luxshare Precision | ✔️ |

| ODM/OEM | Goertek | EssilorLuxottica |

Note: ✔️ indicates supply chain consistency.

This high degree of overlap is primarily due to the limited number of high-quality suppliers capable of meeting the stringent technical requirements of AI glasses during the early expansion phase. We predict that as more companies enter the market, brand manufacturers will have an increasing number of supplier options, effectively driving down BOM (Bill of Materials) costs.

Supply Chain Characteristics: High Geographical Concentration

According to regional heatmap data from the Forward Industry Research Institute, the AI glasses industrial chain exhibits strong geographical concentration: over 70% of upstream, midstream, and downstream enterprises are concentrated in Southern China. Southern China dominates particularly in structural components, power/thermal management, PCBs, communication modules, ODM/EMS, and brand manufacturers.

Why Is Southern China Unavoidable for AI Glasses Production?

Southern China, especially the Pearl River Delta city cluster centered around Shenzhen and Dongguan, has become the global design and manufacturing hub for AI glasses, thanks to over three decades of accumulated expertise in consumer electronics.

- AI Audio Glasses: In the online market, Huawei dominates with an absolute 76.6% market share.

- AI AR Glasses: Thanks to Thunderbird Innovation’s 50% market share, one out of every two AI AR glasses sold globally is “Made in Shenzhen.”

- AI Camera Glasses: The world’s top-selling Ray-Ban Meta is primarily produced at EssilorLuxottica’s automated production line in Dongguan, with an annual production target of 10 million units.

- White-Label AI Glasses: ODM manufacturers and Huaqiangbei enterprises in Southern China contribute the majority of white-label shipments, creating numerous overseas bestsellers.

4.0 Manufacturing Processes and Technical Challenges of Core Components

The final performance, user experience, and cost control of AI glasses directly depend on the manufacturing quality of their core components. In terms of industrial chain added value, aside from chips, the segments with the highest technical barriers and process difficulties are displays, cameras, structural components, batteries/charging, thermal management, as well as midstream ODM/OEM and testing. This chapter delves into these high-value-added segments, revealing their mainstream manufacturing processes and current technical bottlenecks.

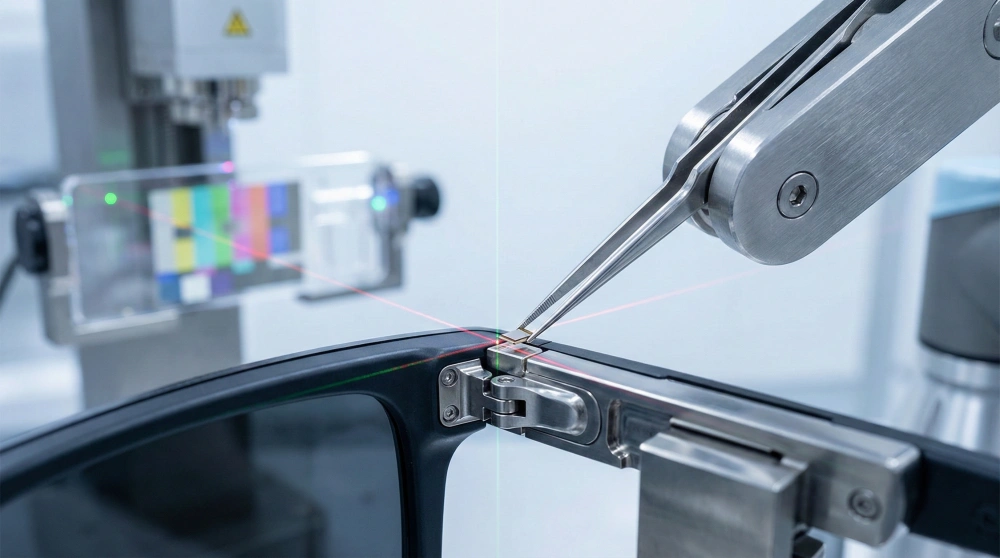

Structural Components – Hinges

Hinges are critical for ensuring smooth folding and stability of temple arms, directly impacting product lifespan and user experience.

- Main Suppliers: Jinyan Technology, Lingyi iTech, Fusida, Changying Precision, etc.

- Mainstream Processes:

- MIM (Metal Injection Molding): Suitable for mass production of small, complex three-dimensional metal parts; currently the mainstream solution.

- CNC (Computer Numerical Control) Machining: Used for more complex hinge structures (e.g., with spirals or curves) or when higher precision and consistency are required.

Structural Components – Connectors

The extremely limited internal space and complex circuit layouts of AI glasses impose stringent requirements for miniaturization and diversity in connectors.

- Application Features: Due to the multi-bend internal structure, FPC (Flexible Printed Circuit) connectors are widely used to link the motherboard, battery, sensors, cameras, and other modules.

- Main Suppliers: Luxshare Precision, Changying Precision, Lianchuang Technology, Deren Electronics, Topsun, etc.

- Key Manufacturing Processes:

- Stamping: High-speed stamping for mass production.

- Micro-Mold Machining: The precision of connector molds determines product quality, relying on CNC, EDM (Electrical Discharge Machining), and wire cutting technologies.

Camera Modules

While AI glasses camera modules can leverage mature smartphone lens manufacturing processes, their greatest challenge lies in extreme miniaturization.

- Main Suppliers: Sunny Optical, OFILM, Crystal-Optech, Yutong Optical, etc.

- Mainstream Lens Manufacturing Processes:

- Injection Molding: For plastic lenses, offering low cost and ease of mass production.

- Mold Core Machining and Compression Molding: For glass-plastic hybrid lenses, enabling smaller volumes and higher imaging quality.

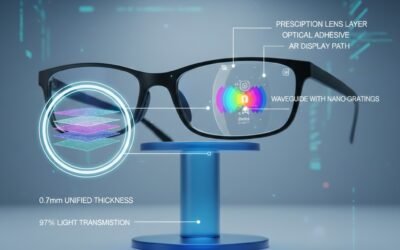

Display Modules – Waveguides

Waveguides are the core technology enabling “thin and light” AR glasses and represent one of the highest technical barriers. Leading brands like Thunderbird, Meizu, and Rokid adopt this solution.

- Main Suppliers: Lumus, Sunny Optical, Crystal-Optech, Lingxi Micro-Optics, Aurora Optoelectronics, etc.

- Mainstream Process Comparison:

| Process Type | Process Flow | Technical Pain Points |

|————–|————–|———————–|

| Array Waveguides | Optical substrate cutting → cold processing grinding/polishing → coating → bonding → cutting → secondary grinding/polishing | High difficulty in mass production, long processing times, low yield rates |

| Surface Relief Waveguides | Master template creation → nanoimprint → UV curing → functional layer coating → laser cutting | Lower difficulty in mass production but smaller field of view (FOV) and light leakage issues |

Batteries

Battery life is a common pain point for all wearable devices. Without increasing the weight of the glasses, the clear technological path to enhancing battery capacity lies in solid-state batteries, which offer higher energy density.

- Technological Path: Transition from traditional lithium batteries to solid-state batteries.

- Manufacturing Challenge: The adoption of solid-state batteries will drive changes in manufacturing processes. Due to the lower toughness of solid-state electrolytes, the “winding” process commonly used in traditional lithium battery production is prone to causing fractures. Therefore, the “stacking” process, which requires higher costs, automation, and testing precision, will become mainstream for future solid-state battery mass production.

- Main Suppliers: Desay Battery, Sunwoda, Zhongke Lanxun, Zhuhai CosMX Battery, EVE Energy, etc.

5.0 Core Pain Points in Automated Final Assembly and Testing

After overcoming the manufacturing challenges of core components, efficiently and reliably assembling these delicate and fragile parts into the final product is the final hurdle in transitioning AI glasses from “concept” to “mass production.” This chapter focuses on automated assembly and testing, systematically analyzing the core pain points faced in these stages. Currently, major OEMs for AI glasses include industry giants such as Goertek, Huaqin Technology, Luxshare Precision, Jiahe Intelligent, Yidong Information, Tianjian Shares, Guoguang Electric, and Longcheer Technology. In practice, they face the following four major challenges:

Pain Point 1: Assembly of Precision Components

- Problem: AI glasses must densely integrate dozens of components, including chips, batteries, sensors, and FPCs, within the limited space of a thumb-sized temple arm.

- Cause: The extreme spatial constraints make thermal design highly challenging. During automated assembly processes (e.g., soldering), rapid local temperature changes can cause thermal expansion of materials, leading to weak or failed solder joints in already installed precision components, severely impacting product yield and reliability.

Pain Point 2: Optical System Testing

- Problem: As the core of AI AR glasses, testing waveguide display modules is a critical bottleneck in yield control.

- Cause: The current mass production yield for waveguide modules is only about 65%. Defects are diverse, including grating distortion, uneven coating, internal impurities, and display color differences. These minor flaws require 100% full inspection, but the industry still lacks efficient, automated testing methods capable of handling multiple defect types.

Pain Point 3: Functional Testing

- Problem: Laboratory or factory test results often fail to replicate real-world usage scenarios, allowing potential defects to reach the market.

- Cause:

- Voice Recognition: Factory test environments are typically quiet, making it difficult to expose issues like reduced voice recognition performance in noisy outdoor or public settings.

- Temperature Management: Standard temperature rise tests are usually conducted in open environments and do not simulate the condition of glasses being worn closely against the skin. This oversight ignores potential localized overheating in temple arms due to poor heat dissipation, affecting comfort.

Pain Point 4: Production Line Changeovers

- Problem: The AI glasses market features numerous brands and diverse models, placing extremely high demands on OEMs’ flexible production capabilities. However, existing automated equipment lacks sufficient flexibility.

- Cause: Due to significant differences in appearance, dimensions, and internal structures among various brands and models of AI glasses, each production line changeover requires complex reconfiguration of robotic arm paths and visual positioning system parameters. This results in extended downtime and low production efficiency, making it difficult to meet the market’s demand for “small batches, multiple varieties.”

These systematic manufacturing pain points not only directly impact the current production capacity and cost of AI glasses but are also closely linked to future product evolution trends, urgently requiring innovative solutions.

6.0 Conclusion: Future Trends and Industrial Opportunities in the AI Glasses Market

This white paper provides a comprehensive analysis of the AI glasses industry, covering market definition, growth trajectory, supply chain overview, core component manufacturing processes, and assembly challenges. Based on this analysis, we can clearly outline the future development blueprint of the industry and identify key industrial opportunities.

Future Product Trends and Manufacturing Challenges

- Lightweight Design

- Trend: To achieve ultimate wearing comfort, future AI glasses will increasingly adopt carbon fiber, TR (thermoplastic resin), magnesium alloy, and titanium alloy to create micro structural components.

- Manufacturing Challenge: These new materials’ micro structural components (e.g., titanium alloy hinges, temple arm pivots) demand extremely high machining precision (tolerances of ±0.01mm). Traditional machining methods struggle with thin-walled, complex structures, often resulting in deformation and compromised precision.

- High Display Quality

- Trend: For AI AR glasses, user expectations for visual experience are endless. Micro-display modules with higher pixel density, refresh rates, and brightness will become mainstream.

- Manufacturing Challenge: Display performance is a systematic engineering effort. If the precision in display module machining, automated assembly, and final testing does not match the upgrade in display panels, the final visual quality will suffer from issues like color deviation and distortion.

- High-Volume Production

- Trend: As market demand surges, increasing production capacity and reducing costs are inevitable choices for all brand manufacturers. Economies of scale will further drive market adoption.

- Manufacturing Challenge: Metal frames and temple arms of AI glasses, which need to integrate speakers, cameras, and other electronic components, are far more structurally complex than traditional glasses, resulting in significantly lower machining yields. Additionally, the industry still lacks effective and rapid testing methods for these complex structural components.

ITES Market Insights Summary

Based on the full analysis, we distill the following final insights into the AI glasses market:

- The market has entered a phase of rapid growth and become a strategic battleground.

The AI glasses market has passed its inflection point, with a projected CAGR exceeding 100% from 2025 to 2030, making it a new blue ocean that upstream, midstream, and downstream enterprises in the 3C electronics supply chain cannot ignore. Due to cost and technological constraints, non-display AI audio and AI camera glasses will continue to dominate the market in the short term. - Southern China has become a manufacturing hub, with Shenzhen emerging as the “AI Glasses Capital of China.”

The powerful industrial cluster effect has established Southern China as the global core base for AI glasses design and manufacturing. For all high-end equipment, automation solution providers, and precision manufacturing enterprises planning to enter the AI glasses industry, closely monitoring and deeply engaging with the Southern China market is key to success. - The industry is entering a “Hundred Glasses War,” with manufacturing pain points creating significant opportunities.

The market is transitioning from a “single solution” to a “diversified” ecosystem, with intensifying competition among brands. Precision machining of structural components, automated assembly and testing, and flexible production have become core bottlenecks limiting the production capacity, yield, and cost of AI glasses. These pain points present unprecedented opportunities for suppliers offering innovative equipment and solutions at platforms like the ITES Shenzhen Industrial Exhibition.

0 Comments