When tech giants like Meta and Apple place their bets on the smart glasses revolution, a remarkable trend is emerging: Chinese companies are moving faster than anyone expected to capture this emerging market.

According to IDC, global smart glasses shipments reached 4.065 million units in the first half of 2025—a 64.2% year-on-year increase—with projections exceeding 40 million units by 2029. China’s market is growing even faster, with a five-year compound annual growth rate of 55.6%, the highest in the world. Perhaps most strikingly, Chinese firms now account for approximately 80% of the global smart glasses supply.

From the early stumble of Google Glass to the hype and reality check of Magic Leap, the smart glasses industry has experienced a decade of ups and downs. Now, with the maturation of AI large language models, the race is heating up again. This time, China’s supply chain companies are establishing a dominant position through innovation, collaboration, and speed.

1. Innovation at the Millimeter—and Nanometer—Scale

On November 27, Alibaba launched six models of its Quark AI glasses, the S1 and G1 series. Behind this seemingly simple product lineup lies breakthroughs from multiple Chinese supply chain companies pushing into technological frontiers.

In Hefei, Jade Bird Display (JBD) delivered the world’s smallest mass-produced AR optical engine—just 0.15 cubic centimeters, 50% smaller than its predecessor. “Alibaba’s miniaturization requirements were extremely challenging,” said JBD COO Xu Huiwen. “It took 40 design iterations and a complete overhaul of the packaging and optical structure to achieve this.”

As the only company mass-producing MicroLED microdisplays, JBD spent a decade building a technology chain spanning three and a half generations of semiconductors. The breakthrough in red light efficiency was particularly difficult. “Red light was the biggest bottleneck—we spent 60–70% of our time improving its efficiency,” Xu noted.

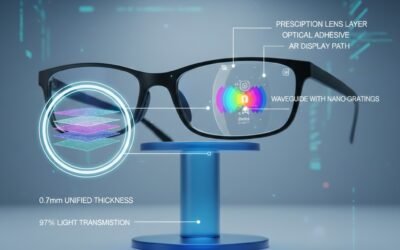

In Zhejiang, ZEGO Tech developed a diffractive waveguide lens just 0.7 mm thick and weighing less than 4 grams, yet capable of delivering over 4,000 nits of brightness. “We solved light leakage with 2D grating technology, making the optical structure nearly invisible at a social distance,” said CEO Meng Xiangfeng.

Spun off from Tsinghua University, ZEGO broke international monopolies in optical waveguide technology. To tackle the persistent issue of rainbow glare, the team tested over 20 coating solutions, eventually eliminating the effect in 95% of scenarios.

In Shanghai, Conant Optical pioneered integrated lamination technology, seamlessly combining prescription lenses, waveguides, and display modules. “This lens integrates optical and display functions with nanometer precision and over 98% light transmittance,” said Chairman Fei Zhengxiang. With nearly 30 years of experience and products sold in 90+ countries, Conant customized millions of SKUs for Quark glasses. “Globally, no more than three companies can achieve integrated lamination with personalized customization,” Fei added.

In Kunshan, Flexium Interconnect developed a seven-layer flexible printed circuit (FPC) for Quark glasses. “We had to fit an AR optical engine, sensors, battery, and more into a 3.3 mm frame—traditional rigid PCBs couldn’t adapt,” said General Manager Chen Qihong. The FPC features high-density wiring with lines and spacing under 0.1 mm and a yield rate exceeding 99.2%.

2. The Collaborative Edge: The Yangtze Delta Two-Hour Supply Circle

While individual breakthroughs matter, China’s real advantage lies in the efficiency of its supply chain collaboration.

“You can source and test all core components without leaving the Yangtze River Delta,” said Meng Xiangfeng. This geographic clustering allows Chinese companies to iterate three times faster than overseas competitors. Flexium, leveraging the regional industrial cluster, cut its sample-to-mass-production cycle to 45 days—50% faster than the industry average.

Unlike traditional buyer-supplier relationships, this AI glasses initiative adopted a “joint innovation” model. Brands and suppliers worked as integrated teams rather than in sequential handoffs.

“Alibaba’s product managers, algorithm engineers, and optical experts came to our lab every week to discuss technical routes, test samples, and optimize parameters,” Meng recalled. “Traditional supply chains are sequential, with iteration cycles of 3–6 months. In this parallel model, we compressed that to 2–3 days.”

JBD’s collaboration with Alibaba began in 2021. “We already had microdisplay technology, but the product definition process clarified our optimization path,” said Xu Huiwen. To meet lightweight demands, JBD reduced optical engine power consumption to under 60 milliwatts—40% below the industry average.

This deep collaboration also helped traditional manufacturers find new growth drivers. Conant accelerated its digital processing R&D to integrate convex, concave, and waveguide lenses into a single mold. “Traditional lens manufacturing can’t meet the composite functional needs of smart glasses,” Fei said.

Luxshare Precision Chairman Wang Laichun described the collaboration as a “dream combination.” “A strong large model platform is the foundation. Without it, hardware alone can’t build a successful brand.” In her view, the AI glasses competition is essentially a contest of “large models plus ecosystem.” “Alibaba’s ecosystem and platform, combined with our smart manufacturing and vertical integration, give us a real chance to build a leading product.”

3. Growth Potential: Nearing the Tipping Point

As hardware becomes lighter, battery life improves, and AI integration deepens, the industry is approaching a breakthrough moment.

“In the next year or two, we’ll see a surge in breakout products,” said Xu Huiwen, pointing to a sharp increase in AI glasses-related orders. Meng Xiangfeng offered a more specific forecast: “From thousands to tens of thousands, and now orders exceeding 100,000 units—we expect the market to multiply next year.”

Cost reduction is a key driver. Through mass production, the cost of Quark’s core components has dropped 30% since R&D began. Nearly 50 AR glasses models worldwide now use JBD’s optical engines, demonstrating the benefits of scale.

Still, industry insiders remain measured. “Going from millions to billions of units will take about a decade, similar to the smartphone adoption curve,” said Xu, who believes the industry is in the “pre-iPhone moment,” with technology and ecosystems still maturing. Meng expects a stable competitive landscape in about five years, pending richer AI ecosystems and cost control.

Wang Laichun is more cautious: “AI glasses are still far from maturity. But in this opportunity, whether it’s Alibaba or us, we should position ourselves, train, and refine our capabilities now.”

Industry observer Zhu Dianrong emphasizes balancing technical performance with user experience. “Ecosystem building can’t rely on hardware companies alone—it requires collaboration with internet platforms, especially high-frequency applications like social and office software, which will determine user retention.”

There’s broad consensus that as technology iteration and ecosystem development converge, smart glasses could become the next human-computer interaction gateway after smartphones.

“Overseas giants have long R&D cycles and lack synergy,” said Xu Huiwen. Meng highlights the vertical integration advantage: “Completing R&D and delivery from 0 to 1 in six months—that’s something overseas players can’t match.”

From optical lenses to micro-display chips, flexible circuits to precision manufacturing, a complete smart glasses industrial chain has taken shape in China.

0 Comments